“CIRCULAR – THE MADHYA PRADESH KARADHAN ADHINIYAMON KI PURANEE BAKAYA RASHI KA SAMADHAN ADHYADESH,2020

“CIRCULAR – THE MADHYA PRADESH KARADHAN ADHINIYAMON KI PURANEE BAKAYA RASHI KA SAMADHAN ADHYADESH,2020

Click Here

“स्टेट बैक आफ इंडिया के माध्यम से आँन –लाईन पेमेंट (कर के भुगतान) में कठिनाई होने की दशा में करदाता द्वारा कर भुगतान हेतु MP Cyber Treasury पोर्टल का उपयोग किया जा सकता है|”

Click to MP Cyber treasury Payment Page

Establishments registered after 15/02/2014 is valid for life-time and need no renewal. Please refer departmental notification dated 8th March 2019 in this regard.

15/02/2014 के पश्चात पंजीकृत स्थापनाओं के प्रमाण पत्र सम्पूर्ण जीवन-काल के लिए वैध हैं एवं उन्हे नवीनीकरण कराने की आवश्यकता नहीं है। कृपया इस संबंध में 8 मार्च 2019 की विभागीय अधिसूचना देखें।

26/10/2020

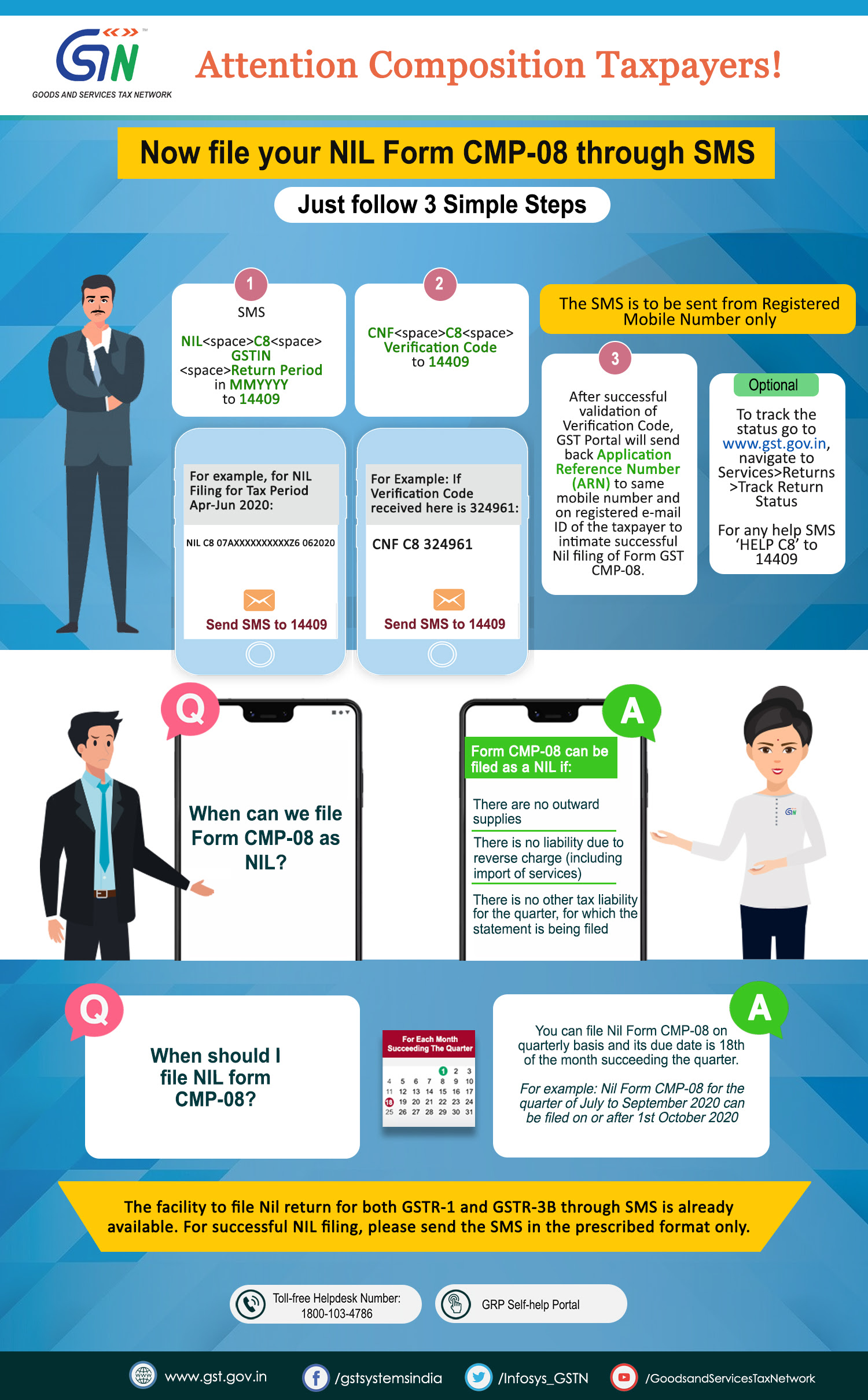

https://tutorial.gst.gov.in/userguide/returns/index.htm#t=FAQs_SMS.htm

Thanking you,

CBDT issues Press Release for extension of due dates for filing Income-tax Returns and Tax Audit Reports under the Income-tax Act, 1961 for AY 2020-21 Click here for Press Release

Clarification in respect of the Direct Tax Vivad se Vishwas Act, 2020 Click here for Circular

Notification No. 88/2020/ F. No. 370142/35/2020-TPL for extension of due dates for filing Income-tax Returns and Tax Audit Reports under the Income-tax Act, 1961 for AY 2020-21 Click here for Notification

Thanking you,