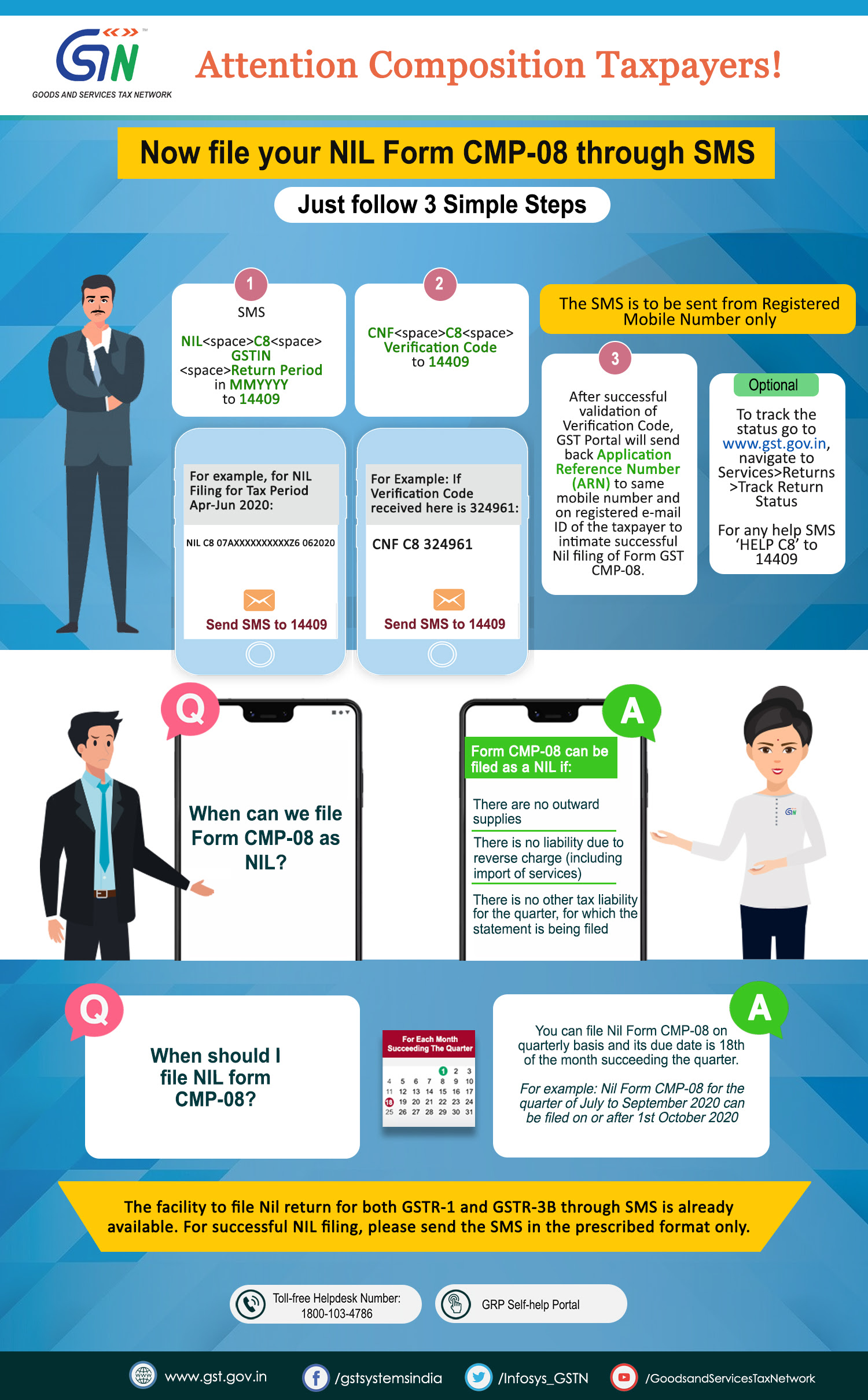

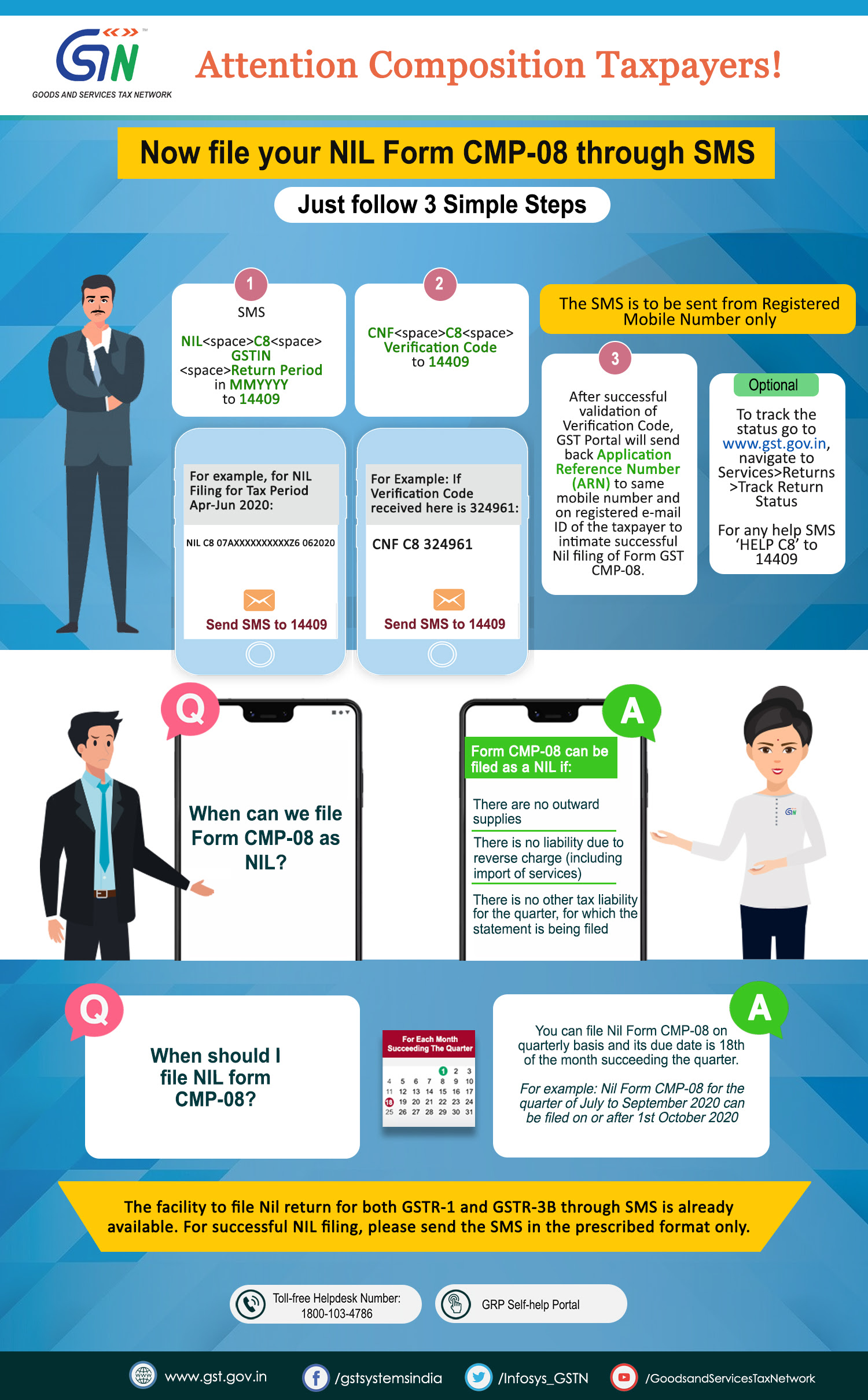

“File your NIL Form CMP-08 through SMS”

“File your NIL Form CMP-08 through SMS”

26/10/2020

https://tutorial.gst.gov.in/userguide/returns/index.htm#t=FAQs_SMS.htm

Thanking you,

CBDT issues Press Release for extension of due dates for filing Income-tax Returns and Tax Audit Reports under the Income-tax Act, 1961 for AY 2020-21 Click here for Press Release

Clarification in respect of the Direct Tax Vivad se Vishwas Act, 2020 Click here for Circular

Notification No. 88/2020/ F. No. 370142/35/2020-TPL for extension of due dates for filing Income-tax Returns and Tax Audit Reports under the Income-tax Act, 1961 for AY 2020-21 Click here for Notification

Thanking you,

| Sl. No | Taxpayers with aggregate turnover (PAN based) in the previous financial year | And Taxpayers having principal place of business in the State/ UT of | Due date of filing of Form GSTR 3B, from October, 2020 till March, 2021 |

|---|---|---|---|

| 1 | More than Rs. 5 Crore | All States and UTs | 20th day of the following month |

| 2 | Up to Rs. 5 Crore | States of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana and Andhra Pradesh , the Union territories of Daman and Diu, Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep | 22nd day of the following month |

| 3 | Up to Rs. 5 Crore | States of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha, the Union territories of Jammu and Kashmir, Ladakh, Chandigarh and Delhi | 24th day of the following month |

Thanking you,

CBDT issues Press Release for extension of due dates for filing Income-tax Returns and Tax Audit Reports under the Income-tax Act, 1961 for AY 2020-21

Government of India

Department of Revenue

Ministry of Finance

Central Board of Direct Taxes

New Delhi, 24th October, 2020

PRESS RELEASE

Extension of due date of furnishing of Income Tax Returns and Audit

Reports

In view of the challenges faced by taxpayers in meeting the statutory and

regulatory compliances due to the outbreak of COVID-19, the Government brought the

Taxation and Other Laws (Relaxation of Certain Provisions) Ordinance, 2020 (‘the

Ordinance’) on 31st March, 2020 which, inter alia, extended various time limits. The

Ordinance has since been replaced by the Taxation and Other Laws (Relaxation and

Amendment of Certain Provisions) Act.

2. The Government issued a Notification on 24th June, 2020 under the

Ordinance which, inter alia, extended the due date for all Income Tax Returns for the

FY 2019-20 (AY 2020-21) to 30th November, 2020. Hence, the returns of income which

were required to be filed by 31st July, 2020 and 31st October, 2020 are required to be

filed by 30th November, 2020. Consequently, the date for furnishing various audit

reports including tax audit report under the Income-tax Act, 1961 (the Act) has also

been extended to 31st October, 2020.

3. In order to provide more time to taxpayers for furnishing of Income Tax

Returns, it has been decided to further extend the due date for furnishing of Income-Tax

Returns as under:

(A) The due date for furnishing of Income Tax Returns for the taxpayers

(including their partners) who are required to get their accounts audited [for whom the

due date (i.e. before the extension by the said notification) as per the Act is 31st

October, 2020] has been extended to 31st January, 2021.

(B) The due date for furnishing of Income Tax Returns for the taxpayers who

are required to furnish report in respect of international/specified domestic transactions

[for whom the due date (i.e. before the extension by the said notification) as per the Act

is 30th November, 2020] has been extended to 31st January, 2021.

(C) The due date for furnishing of Income Tax Returns for the other taxpayers

[for whom the due date (i.e. before the extension by the said notification) as per the Act

was 31st July, 2020] has been extended to 31st December, 2020.

4. Consequently, the date for furnishing of various audit reports under the

Act including tax audit report and report in respect of international/specified domestic

transaction has also been extended to 31st December, 2020.

5. Further, in order to provide relief to small and middle class taxpayers, the

said notification dated 24th June, 2020 had also extended the due date for payment of

self-assessment tax for the taxpayers whose self-assessment tax liability is up to Rs. 1

lakh. Accordingly, the due date for payment of self-assessment tax for the taxpayers

who are not required to get their accounts audited was extended from 31st July, 2020 to

30th November, 2020 and for the auditable cases, this due date was extended from

31st October, 2020 to 30th November, 2020.

6. In order to provide relief for the second time to small and middle class

taxpayers in the matter of payment of self-assessment tax, the due date for payment of

self-assessment tax date is hereby again being extended. Accordingly, the due date for

payment of self-assessment tax for taxpayers whose self-assessment tax liability is up

to Rs. 1 lakh has been extended to 31st January, 2021 for the taxpayers mentioned in

para 3(A) and para 3(B) and to 31st December, 2020 for the taxpayers mentioned in

para 3(C).

7. The necessary notification in this regard shall be issued in due course.

(Surabhi Ahluwalia)

Commissioner of Income Tax

(Media & Technical Policy)

Official Spokesperson, CBDT

Government of India, vide Notification No. 29/2020 – Central Tax, dated 23rd March, 2020, had staggered filing of Form GSTR-3B, for the tax periods of April to September, 2020.

The due dates for filing of GSTR-3B returns for tax period of September, 2020, are as given below:

| Sl. No | Taxpayers with aggregate turn over (PAN based) in the previous financial year | And Taxpayers having principal place of business in the State/ UT of | Due date of filing of Form GSTR 3B, for September, 2020 |

|---|---|---|---|

| 1 | More than Rs 5 Crore | All States and UTs | 20th October, 2020 |

| 2 | Upto Rs 5 Crore | State of Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana or Andhra Pradesh or the Union territories of Daman and Diu and Dadra and Nagar Haveli, Puducherry, Andaman and Nicobar Islands and Lakshadweep | 22nd October, 2020 |

| 3 | Upto Rs 5 Crore | State of Himachal Pradesh, Punjab, Uttarakhand, Haryana, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand or Odisha or the Union territories of Jammu and Kashmir, Ladakh, Chandigarh and Delhi | 24th October, 2020 |

This is for information and necessary action please.

Thanking You,

The facility to file GSTR 3B and GSTR-1 with the EVC in lieu of DSC extended to the registered person, who are also registered under the Companies Act, 2013, shall be withdrawn w.e.f. 1st Nov. 2020. However, facility to file NIL returns through OTP verification, shall be continued for all types of registered persons in view of notification 58/2020- dated 1st July 2020