gst practitioner exam application registration started

GOVERNMENT OF INDIA

MINISTRY OF FINANCE, DEPARTMENT OF REVENUE

NATIONAL ACADEMY OF CUSTOMS, INDIRECT TAXES & NARCOTICS, FARIDABAD

PRESS RELEASE

September 17th , 2018

EXAMINATION FOR CONFIRMATION OF ENROLLMENT OF GST PRACTITIONERS

The National Academy of Customs, Indirect Taxes and Narcotics (NACIN) has been authorized

to conduct an examination for confirmation of enrollment of Goods and Services Tax

Practitioners (GSTPs) in terms of the sub-rule (3) of rule 83 of the Central Goods and Services

Tax Rules, 2017, vide Notification No. 24/2018-Central Tax dated 28.5.2018.

The GSTPs enrolled on the GST Network under sub-rule (2) of Rule 83 and covered by clause

(b) of sub-rule (1) of Rule 83, i.e. those meeting the eligibility criteria of having enrolled as

sales tax practitioners or tax return preparer under the existing law for a period not less than

five years, are required to pass the said examination before 31.12.2018 in terms of second

proviso to rule 83(3). The examination for such GSTPs shall be conducted on 31.10.2018 from

1100hrs to 1330 hrs at designated examination centres across India.

It will be a Computer Based Exam. The registration for this exam can be done by the eligible

GSTPs on a registration portal, link of which will also be provided on NACIN and CBIC

websites. The registration portal will be activated on 25th September, 2018 and will remain

open up to 10th Oct 2018. For convenience of candidates, a help desk will also be set up, details

of which will be made available on the registration portal. The applicants are required to make

online payment of examination fee of Rs. 500/- at the time of registration for this exam.

Pattern and Syllabus of the Examination

PAPER: GST Law & Procedures:

Time allowed: 2 hours and 30 minutes

Number of Multiple Choice Questions: 100

Language of Questions: English and Hindi

Maximum marks: 200

Qualifying marks: 100

No negative marking

Syllabus:

1. Central Goods and Services Tax Act, 2017

2. Integrated Goods and Services Tax Act, 2017

3. State Goods and Services Tax Acts, 2017

4. Union Territory Goods and Services Tax Act, 2017

5. Goods and Services Tax (Compensation to States) Act, 2017

6. Central Goods and Services Tax Rules, 2017

7. Integrated Goods and Services Tax Rules, 2017

8. All State Goods and Services Tax Rules, 2017

9. Notifications, Circulars and orders issued from time to time.

Link.

https://nacin.onlineregistrationform.org/NACIN/LoginAction_loadIndex.action

IMPORTANT DATES

| Commencement of on-line submission of application form | 25/09/2018 at 00:00 AM |

| Last Date of submitting the details Application form | 10/10/2018 at 11:59:59 PM |

| Hall Ticket / Admit Card can be downloaded (Tentative) | 20/10/2018 |

| Date of Computer Based Test | 31/10/2018 |

| Declaration of Result / Merit List | 05/11/2018 |

Candidate Instruction

Please carefully read the following instructions for filling up application form:

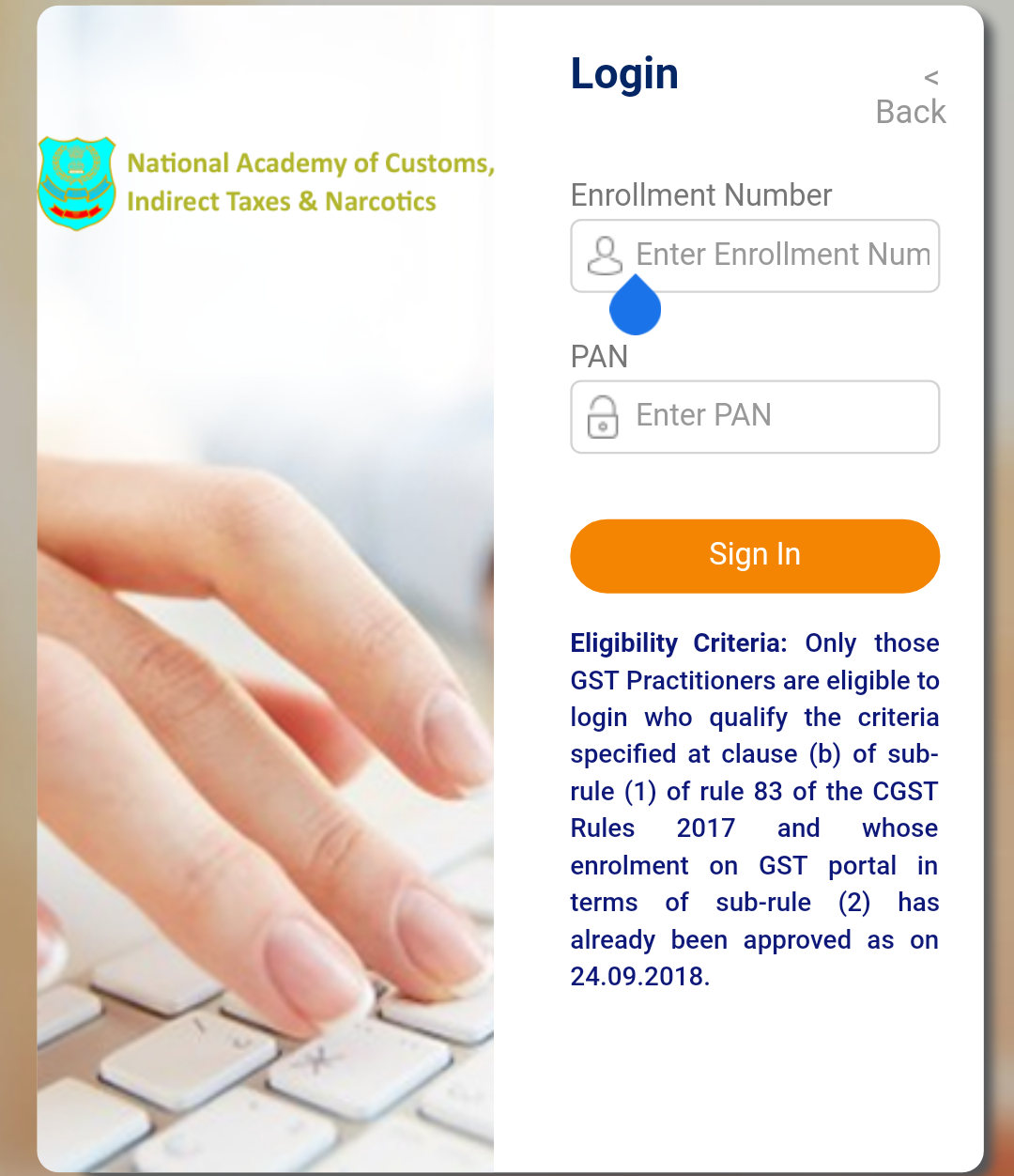

- Only those GST Practitioners are eligible to login who qualify the criteria specified at clause (b) of sub-rule (1) of rule 83 of the CGST Rules 2017 and whose enrolment on GST portal in terms of sub-rule (2) has already been approved as on 24.09.2018.

- Candidates are required to login on Examination registration portal with the help of GST enrolment number (login id) and PAN no. (password).

- The GST enrolment number has been provided to each eligible candidate by GSTN on his enrolment on the GST portal.

- Application form will appear on the screen after a candidate successfully logs in.

- Based on the GST enrolment number and PAN number provided by a candidate on the login page, the application form will auto-populate candidate’s data already available with the GST Network such as name, address, mobile number, email address etc. This data is the same which was provided by the candidate in Form PCT-01 while applying for enrolment as GST Practitioner on the GST portal.

- Hence, in the online application form on this Examination registration portal, a candidate is required to fill in/provide only the following information/documents:

- three choices of test centres (stations) from the drop-down menu,

- softcopy of passport size photograph (File Type JPG, JPEG, PNG of Size 20 to 60 KB), and

- softcopy of signatures(File Type JPG, JPEG, PNG of Size 10 to 30 KB).

The candidates will be prompted to choose from the following list of test centres (stations):

Sr. No. City Name Sr. No. City Name 1 Hyderabad 18 Imphal 2 Itanagar 19 Shillong 3 Dispur 20 Aizawl 4 Patna 21 Kohima 5 Raipur 22 Bhubaneswar 6 Panaji 23 Jaipur 7 Ahmedabad 24 Gangtok 8 Chandigarh 25 Chennai 9 Shimla 26 Agartala 10 Jammu 27 Dehradun 11 Srinagar 28 Lucknow 12 Ranchi 29 Kolkata 13 Bengaluru 30 Mysore 14 Pune 31 Delhi 15 Thiruvananthapuram 32 Guntur 16 Bhopal 33 Puducherry 17 Mumbai - Once a candidate submits completed application form on the registration portal, he will be prompted to pay the examination fee of Rs 500 online.

- On completion of online fee payment, the candidate will be guided to access ‘Candidate’s Dashboard’ from where the submitted application as well as Admit Card can be downloaded. Score card and Examination Certificate will also be made available for download on the same Dashboard.