TDS, TCS for GST kick-in from October 1: Deduction, registration, compliance, challenges – All you need to know

TDS, TCS for GST kick-in from October 1: Deduction, registration, compliance, challenges – All you need to know

The GST law requires TDS to be deducted by certain specified Government bodies/ PSUs, where the total value of supply, under a contract, exceeds Rs. 2,50,000.

By: September 27, 2018 8:08 PM

NEXT

The sudden but delayed implementation of TDS provisions from 1 st October 2018 has presented certain challenges amongst the industry.

By Badri Narayanan & Shweta Walecha

After the GST regime gained momentum, the government decided to introduce TDS and TCS provisions. The GST law requires TDS to be deducted by certain specified government bodies/ PSUs, where the total value of supply, under a contract, exceeds Rs 2,50,000.

The recipient of supply i.e. the TDS Deductor is obligated to deduct 2% (1% CGST + 1% SGST) from the payment made or credited for taxable goods or services or both. The aim to bring this provision is to keep a watch on tax evasion and leakages to the extent possible.

The sudden but delayed implementation of TDS provisions from 1 st October 2018 has presented certain challenges amongst the industry. The challenges would range from initial hiccups to long-lasting impact on the business of companies. Some noticeable challenges with this implementation are outlined below.

Transitioning to TDS:

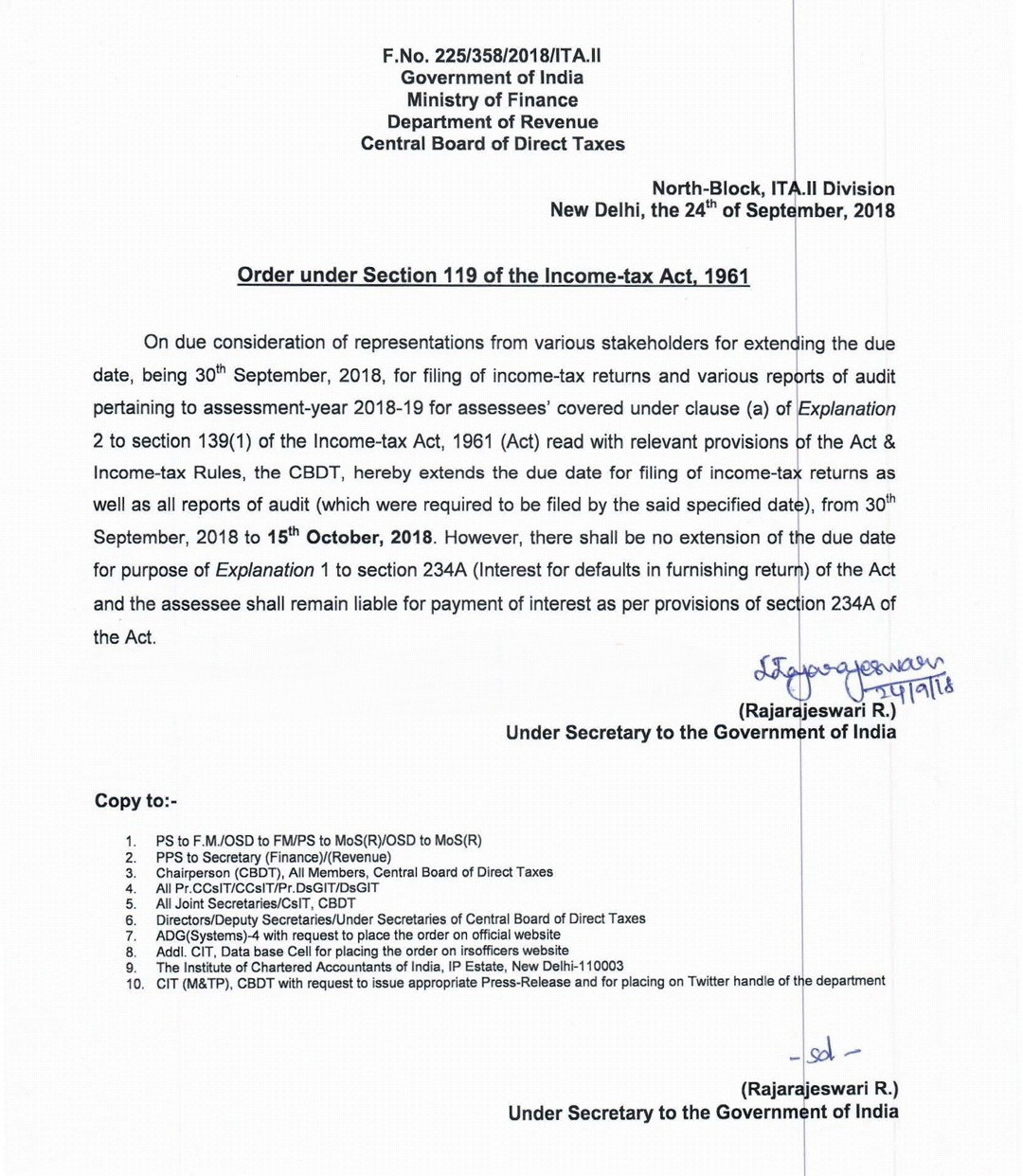

The priority for the deductors at this stage is smooth transition considering the additional compliance and legal requirements to deduct tax. This has resulted in businesses analyzing the trigger point for deduction of tax. One key issue is whether TDS provisions apply to supplies made prior to 1 st October but where payments are received after this date. In order to answer this question, the interpretation of legal provisions becomes critical.

TDS on inter-State supplies:

The GST Law excludes TDS where the supplier registration and the place of supply registration of the TDS deductor are in different states. The provisions do not say that TDS is not applicable to inter-State supplies. However, the FAQ

released by Karnataka Government seems to indicate TDS is not to be deducted on inter-State supplies (irrespective of the location of supplier/ place of supply/ location of recipient).

Although the understanding in the FAQ seems to be incorrect, the Department is yet to clarify this position or make the relevant changes to the law. Till then, it remains unclear whether TDS is to be deducted on inter-State supplies.

TDS on inter-unit transactions:

The transactions between two registrations of a same company (even without any consideration) are taxable under GST. As per the provision under TDS, deduction is to be made on payment made or credited to the supplier.

Different companies follow different practices with respect to the compensation mechanisms between its units. In such cases, TDS provisions may pose significant accounting and legal challenges.

Contract value or supply value?

The TDS provision specifies that the tax is to be deducted where the total value of such supply, under a contract, exceeds 2.5 lakh. The question that arises is whether the tax is to be deducted for all supplies under one contract, where the contract value exceeds 2.5 lakh, or the value qua each supply is to be considered irrespective of the contract value. In absence of clarification, the provision could have serious ramifications.

Deduction of exempt supplies?

As per the legal provisions, TDS is to be deducted from payments made or credited for taxable goods or services or both. Taxable supplies have been defined as “supply of good or services or both leviable to tax under the Act”. Therefore, the supplies which have been made exempt by virtue of exemption notifications would also be considered as taxable supplies.

This brings us to the question, whether TDS is to be deducted on payments pertaining to supplies which have been made exempt? Under the Income Tax Law, various Circulars have clarified the non-requirement of deduction in

situations where the income is unconditionally exempt. Under GST laws, similar clarifications have not been issued and have been a concern for companies.

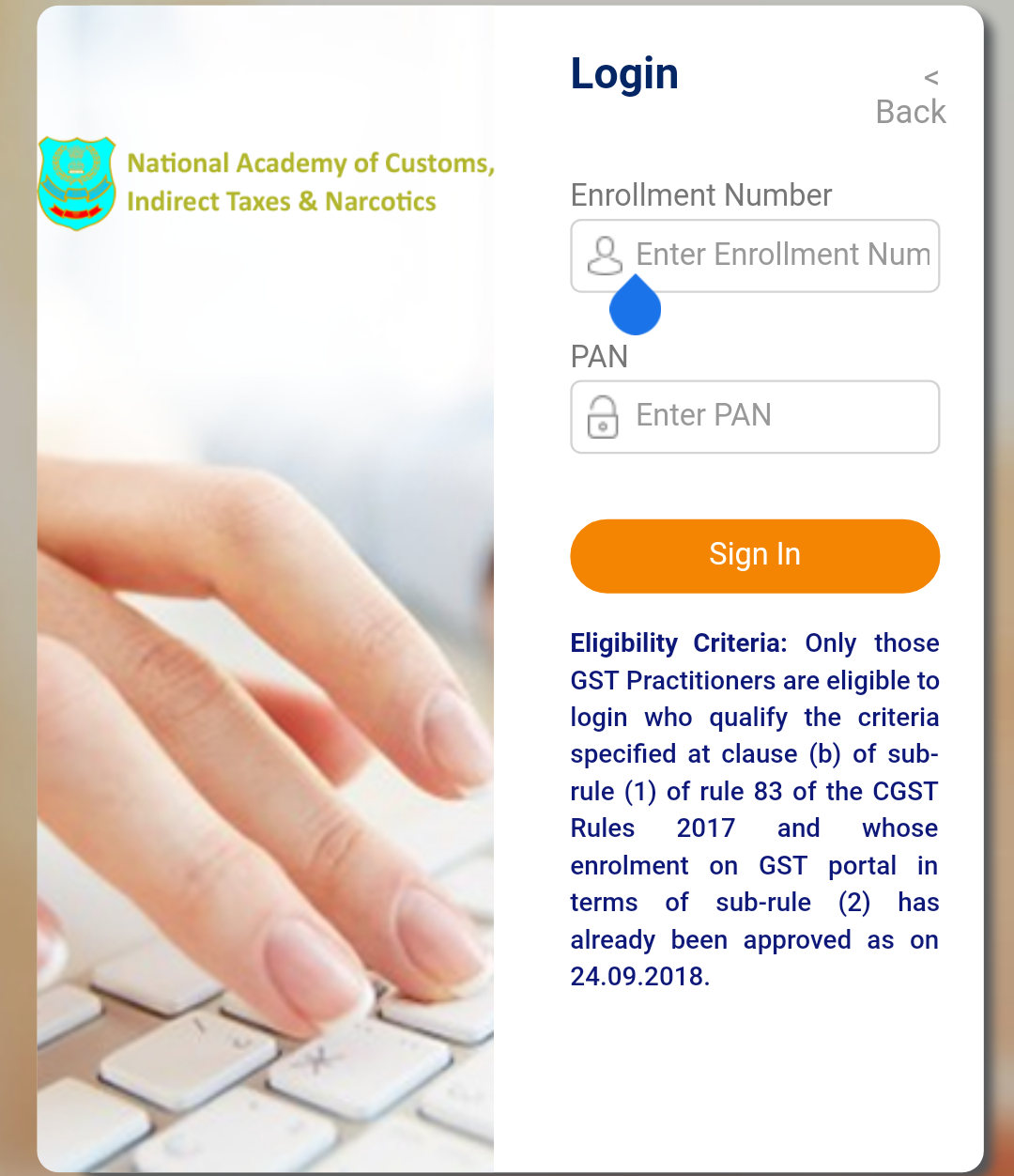

Compulsory registration for deductors:

Persons who are required to deduct tax are required to obtain registration (whether or not registered separately). The provision does not address the situation where a person is operating through multiple places of business in one State. It remains unanswered whether such a person would require separate registration for each place of business to comply with the compulsory registration provision or a single registration for the entire State would be enough.

Additional compliance burden:

In addition to legal issues, the business would be required to prepare themselves for certain compliance requirements. Over and above the existing returns, the person deducting the tax would also be required to file GSTR-7 for furnishing the details of tax deducted.

The Deductor would also be required to furnish to the Deductee (supplier of goods or services) a TDS certificate mentioning the contract value, rate of deduction, amount deducted, and amount paid to the government within 5 days from the date the TDS is deposited.

With fresh challenges under the GST, all the stakeholders must be ready for implementation of the TDS provisions before 1 st October 2018. There is a dire need to clarify the open issues to avoid confusion.

It will be interesting to see whether the issues relevant for TDS implementation are discussed and clarified during the 30th GST Council Meeting scheduled on 28.09.2018. We can only wait and watch.

Source

ttps://financialexpress.com